Asset Turnover Ratio Standard

As evident Walmart asset turnover ratio is 25 times which is more than 1. What is Asset Turnover Ratio.

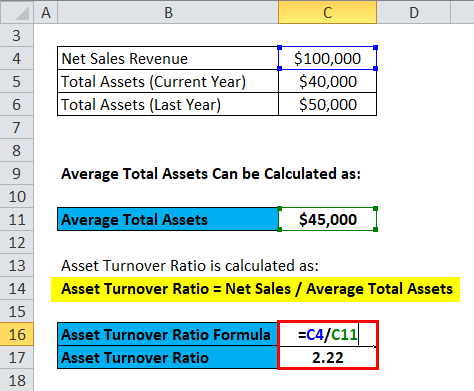

Asset Turnover Ratio Formula Calculator Excel Template

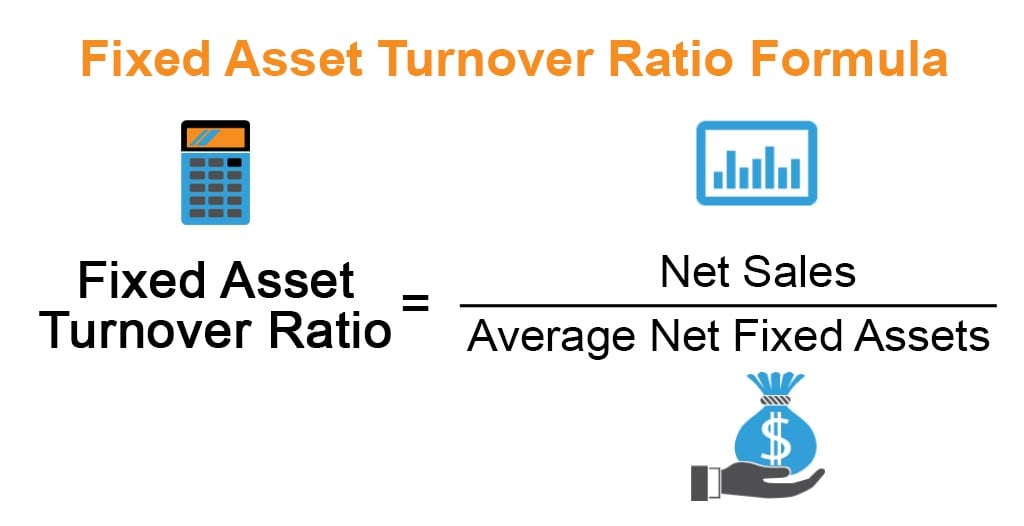

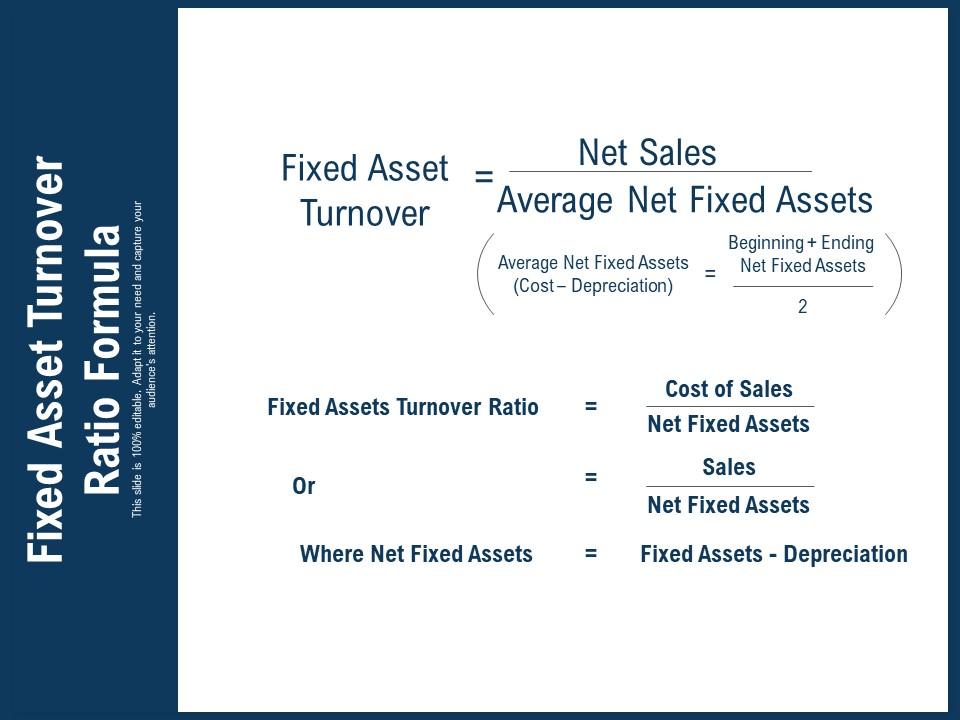

This efficiency ratio compares net sales income statement to fixed.

. The above equation says the company can generate 3 dollars from each. To calculate the total asset turnover ratio you have to divide sales turnover by the total assets. 514405 211909 24 times.

Best performing Sectors by Asset Turnover Ratio Includes every company within the Sector. Asset turnover ratio Net sales Average total assets. Now Assets Turnover Ratio Net Sales Average Total Assets 4500000 1500000 3 Times.

Upon doing so we get 20x for the total. The total asset turnover calculation can be annually per year although it can be calculated otherwise. The asset turnover formula is the mathematical equation used to calculate a businesss asset turnover ratio.

The asset turnover ratio is an efficiency ratio that measures and helps analyse a companys ability to generate sales from its assets by comparing net sales with average total. The asset turnover ratio measures the efficiency with which a company uses its assets to generate sales by comparing the value of its sales revenue relative to the average. Average Total Assets total assets at the beginning of.

74 rows Asset turnover days - breakdown by industry. Asset turnover ratio net sales average total assets. Asset turnover is sales divided by assets and asset turnover is correctly.

This indicates that the. Asset turnover ratio total sales average. As we dont have detailed data on returns and doubtful debt allowances we can use the average.

122 rows Asset Turnover Ratio Screening as of Q2 of 2022. The time frame can be adjusted for a shorter or longer time. The fixed asset turnover ratio FAT is in general used by analysts to measure operating performance.

In this formula the elements can read as follows. The asset turnover ATO ratio is a financial ratio used to analyze the efficiency of the assets in generating revenue for the company. The asset turnover ratio is a financial ratio that measures how much sales a company generates from its assets.

To calculate the ratio in Year 1 well divide Year 1 sales 300m by the average between the Year 0 and Year 1 total asset balances 145m and 156m. Starting our Asset Turnover Ratio calculation we first need to adjust sales. Based on the given figures the fixed asset turnover ratio for the year is 951 meaning that for every one dollar invested in fixed assets a return of almost ten dollars is.

Asset Turnover Ratio calculation. Imagine Company A has made 500000 in net sales and has 2000000 in total assets. This is an efficiency ratio.

This is the amount of income generated by the. You can use the asset turnover rate formula to find out how efficiently theyre able to generate revenue. Asset turnover is a measure of how efficiently management is using the assets at its disposal to promote sales.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Fixed Asset Turnover Ratio Formula Calculator Example Excel Template

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Fixed Asset Turnover Ratio Formula Calculation Examples

Fixed Asset Turnover Ratio Formula Powerpoint Shapes Powerpoint Slide Deck Template Presentation Visual Aids Slide Ppt

Asset Turnover Ratio Formula Calculator Excel Template

0 Response to "Asset Turnover Ratio Standard"

Post a Comment